One of the fascinating arguments of the contemporary time that we live in is that between the adversaries and supporters of cryptocurrencies. On one side, those against digital currency say that Bitcoin and other such cryptocurrencies are a type of gimmick. Individuals who are “tricked” into getting them will before long pay a heavy price for their innocence, while supporters maintain that it is a genuine asset. The basic logic behind the issue to be so troublesome is straightforward – the two sides can’t generally concur on what precisely constitutes digital currency.

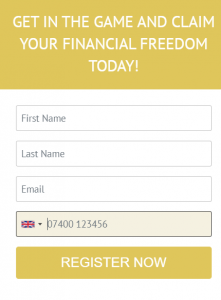

The most convincing point is that Bitcoin and other digital currencies are not money producing assets; rather, these are types of money with highlights of commodities. This implies they can’t be invested or valued but can only be traded and priced. Users who have visited trusted trading sites will understand what that means, and hence, we will try to further analyze the differences between the different forms of investment to place cryptocurrency within a classification. You can visit the trusted site like Crypto Engine by clicking the image below

Understanding commodities, assets, and currencies – For a correct understanding of cryptocurrency and its classification, the different forms of investment must be known. Thus, we take a look at them in the following sections.

Commodity

A commodity’s value originates from its utility that can meet a specific human need like food, shelter, or energy. Value estimation can be done by determining the demand and supply of the commodity, but those processes will take ample time. Thus, evaluating commodities can be a difficult process as compared to cash-producing assets. Potentially the best representation of comparability between conventional commodities and digital forms of money is its similarity with gold.

As a hard asset, both of them share similar qualities like limited supply, natural worth, and particular shortage. Thus, it shows that cryptocurrencies are not just a type of resource, but they can also be a suitable trading mode.

Cash producing asset

An asset is an entity that creates income at the moment or can produce income later on. When a person invests in a business, it can be called an asset, and similarly, to all types of development that can be associated with the business’ income. These developments can be in the form of equities, bonds, and debts, or some other options. A common characteristic of all assets pertains to their flow of cash so that they all enjoy a value. Assets with a high flow of cash and low risks can be more valued than those with a low flow of cash and substantial risk.

As referenced previously, digital currencies do not enjoy cash inflows and cannot be seen in isolation like a traditional currency. Thus, cryptocurrencies cannot be called cash-producing assets.

Currency

Currency can be characterized as an exchange medium to improve the selling and purchasing process and one that can help in healthy cash flow. Seen in seclusion, they do not have cash flows and may not be valued. Anyway, they can be evaluated by making a comparison with other currencies. In the long haul, any currency that is popularly accepted as a mode of trade and can keep up its purchasing power can expect price appreciation compared to one that does not display these properties.

But within a shorter time period, the price of a currency can fluctuate due to factors like exchange rate control by governments. Just like any currency, most cryptocurrencies can be used for trading in goods or services because they have global acceptance as feasible methods of payment. Cryptocurrencies are not supported by any region or nation as authentic monetary tools. In this regard, digital currencies can be seen as a bartering tool as compared to real money.

Conclusion

The phenomenal value appreciation of Bitcoin and many other digital currencies, along with their foray into conventional monetary markets, has brought the focus on virtual currencies. But the opinion still seems to be fairly divided on whether they can be seriously called commodities or currencies. The point is that either of them can be justified, although the official reply will depend to a large extent on the place where one resides, and the political influence exerted on it at that place. Thus, a very clear answer to whether Bitcoin can be indeed called a currency is still debatable and open to scrutiny.